The Hip Money app helps you save more money & eliminate debt with a swipe right. To start, you simply connect the app to your checking account so we can analyze your cash flow, not to judge you but to gently nudge you you’re your customized savings recommendation. You then add in goals or existing debt and it helps you clearly understand what a small amount today can mean in the future toward each goal.

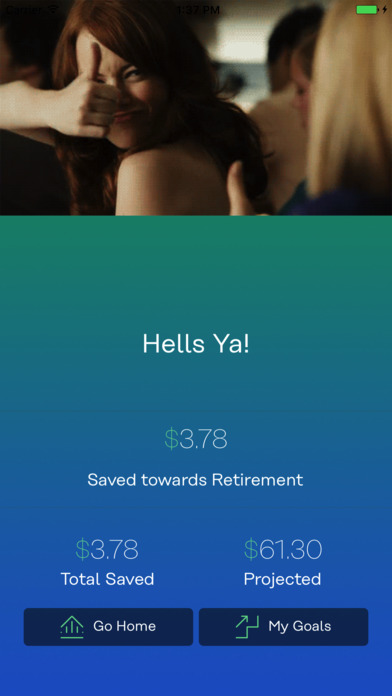

Then, you act on your decision with a simple swipe to save. And cue the GIF party!

No thinking, no spending change, no math. This is savings made hip and simple!

**As seen in the successful 2016 Kickstarter Campaign and at SXSW Accelerator Pitch Contest**

Hip Money uses auto renewable subscriptions available in both monthly and yearly pricing.

– Payment will be charged to iTunes Account at confirmation of purchase

– Subscription automatically renews unless auto-renew is turned off at least 24-hours before the end of the current period

– Account will be charged for renewal within 24-hours prior to the end of the current period, and identify the cost of the renewal

– Subscriptions may be managed by the user and auto-renewal may be turned off by going to the users Account Settings after purchase

– Any unused portion of a free trial period, if offered, will be forfeited when the user purchases a subscription to that publication, where applicable

Privacy Policy: https://s3.amazonaws.com/hipmoney-docs/hipmoney-privacy-policy.pdf

Terms of use: https://s3.amazonaws.com/hipmoney-docs/hipmoney-terms-of-service.pdf

Frequently Asked Questions

How does Hip Money work?

Hip Money connects to your primary person checking

account to analyze your cash flow and spending patterns. When appropriate, we notify you of a personal savings recommendation. You can opt to save that amount or customize it and specify a savings goal within your Hip Money account. Funds are then moved via ACH by our FDIC-insured bank partner from your checking account to the desired savings bucket within your Hip Money account. Easily withdraw your money at any time you desire.

What makes Hip Money different than my current savings account?

Hip Money helps you identify extra, incremental amounts to save based on your lifestyle! This is money above and beyond what you might normally be doing. The Hip Money account from our partner bank also pays you .60% annual percentage yield (APY) currently, which is more than most bank and credit union savings accounts.

How long does it take for my Hip Money savings transfers to happen?

To keep costs low and offer our users a great interest rate on their savings with us, we process your savings “actions” at the end of each business day via ACH with our partner bank. Transactions can take up to three business days to process.

Is Hip Money safe and secure?

Yes. Hip Money uses standard industry security measures to encrypt your personal information and utilizes secure APIs from our FinTech partners to never store any of your login, security or account information.

Is there a charge for Hip Money?

Yes. We charge a fee for the use of our app. See app for details on pricing options starting as low as $2.

Where is Hip Money currently available?

We currently have the capability to offer connection to more than 10,000 banks and credit unions in the US. We don’t currently offer any ability to connect to accounts outside of the US.

Do I need a savings account?

No. When you signup for Hip Money you get your own Hip Money account which will hold any Hip Money savings until withdrawn. Any funds held in your Hip Money account are held in a custodial account at our partner bank and are insured up to the maximum FDIC insurance, which is currently $250,000.

How do I access my Hip Money savings?

You can withdraw your savings at anytime and as many times as you want per month. To do this, use the Transfer feature in the app.